In international trade, choosing the right delivery terms is crucial for both buyers and sellers. DDP and DAP have different characteristics and are suitable for different trade scenarios. This article will introduce the differences between the two in detail to help companies make better choices.

Learn more: The 11 Common International Trade Terms

Overview of DDP

DDP terms require the seller to bear all costs and risks from the shipment of goods to the delivery of the goods to the buyer’s designated place, including customs clearance, payment of import duties and taxes. The buyer only needs to receive the goods without having to deal with additional procedures.

Responsibilities of DDP

- The seller bears all transportation risks from shipment to the buyer’s designated place.

- The seller is responsible for customs clearance and payment of destination duties and VAT.

- The buyer’s risk starts when the goods are delivered.

Overview of DAP

DAP terms stipulate that the seller is responsible for delivering the goods to the buyer’s designated place, but does not bear the destination customs clearance and tax payment. The buyer needs to complete import customs clearance and pay duties and taxes on his own.

Responsibilities of DAP

- The seller is responsible for transportation risks until the goods arrive at the destination, but customs clearance and tariffs are the responsibility of the buyer.

- The buyer may face additional delays and cost risks during customs clearance.

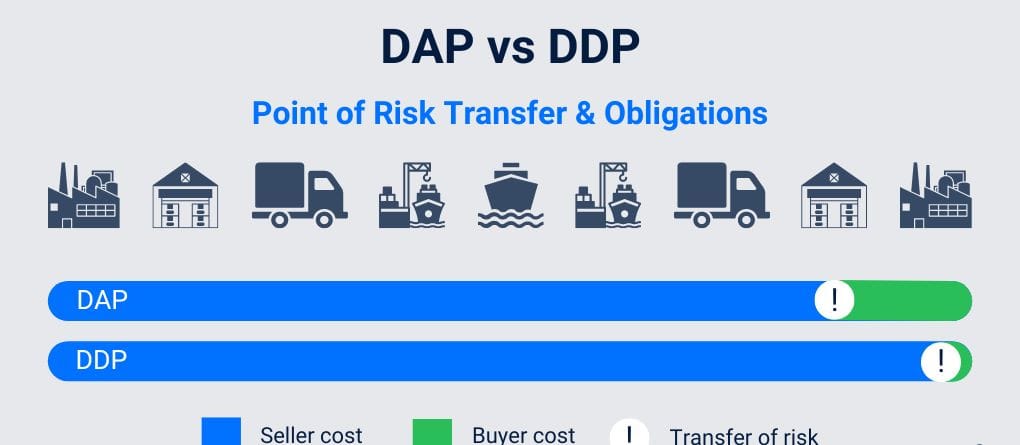

Differences Between DDP and DAP

Different trade terms have different meanings in international transportation. DDP and DAP have obvious differences in transportation responsibilities, cost division and customs clearance responsibilities:

| Difference | DDP | DAP |

| Customs clearance responsibility | The seller is responsible for handling import customs clearance and paying import duties and taxes. | The buyer is responsible for handling import customs clearance. |

| Duties and taxes | The seller bears import duties and taxes of the destination country. | The buyer is responsible for paying all import duties and taxes. |

| Delivery of goods | Directly receive the duty-paid goods at the destination. | Handle customs clearance after receiving the goods at the destination. |

| Logistics Operation | The seller needs to cooperate with the local customs clearance agent to complete all customs clearance procedures at the destination. | The seller is only responsible for transportation and destination delivery, reducing the complexity of customs clearance. |

How to Choose DDP or DAP

Scenarios for choosing DDP

- The buyer has no customs clearance capability or experience and is unfamiliar with import customs clearance and tax policies.

- The buyer wants to simplify logistics operations and focus on other businesses.

- The seller has a full understanding of the customs clearance policy of the destination and can provide one-stop service.

- Long-term cooperation and the buyer trusts the seller’s customs clearance capability.

Scenarios for choosing DAP

- The buyer is skilled in customs clearance and has a partner.

- The buyer wants to control the time and method of payment of import taxes and fees.

- The customs clearance policy is complicated or requires a special license.

- New partnership or uncertain market environment.

You may also be interested in: The Difference Between DDU and DDP in International Trade

Risks and Considerations

Both DDP and DAP have their own risks. Consider the following risks:

Risks of DDP

- The seller needs to be familiar with the import regulations and tariff rates of the buyer’s country.

- The seller needs to bear the possible delays or additional costs in the import customs clearance process.

- The tax rates in the destination country may be higher. The seller needs to consider whether these costs can be controlled.

Risks of DAP

- The buyer needs to be familiar with the customs clearance process in his or her country and bear the possible delays or additional costs in customs clearance.

- The buyer needs to confirm the cargo handling arrangements at the destination (such as port operations or storage fees)

DDP and DAP have their own characteristics. Through this article, you can learn more about the division of responsibilities, risks and costs of both parties, and complete international trade transportation more efficiently.